Galpin & myKaarma: Creating a State-of-the-Art Payments Experience

Galpin Motors has always been an innovator in automotive retail. From opening the nation’s first in-dealership restaurant to pioneering alternative fuel stations, Galpin has built its reputation on delivering forward-thinking experiences to its customers. Today, that spirit of innovation extends into the world of payments, where Galpin partners with myKaarma to create a seamless, efficient, […]

Galpin Motors has always been an innovator in automotive retail. From opening the nation’s first in-dealership restaurant to pioneering alternative fuel stations, Galpin has built its reputation on delivering forward-thinking experiences to its customers. Today, that spirit of innovation extends into the world of payments, where Galpin partners with myKaarma to create a seamless, efficient, and legally compliant payment ecosystem for both customers and the business office.

Introducing Mike Bosch

At the center of Galpin’s payments transformation is Mike Bosch, Project Manager for Galpin Motors. With more than 12 years at the company, Bosch has been a longtime supporter of myKaarma and a key advocate for leveraging its tools to modernize Galpin’s operations. His perspective highlights not just the technical benefits, but also the cultural shift in how payments are handled.

A Journey from Manual to Modern

For decades, automotive dealerships relied on credit card terminals and manual reconciliation. Payments were disconnected from Dealer Management Systems (DMS), requiring back-office teams to spend hours reconciling batch reports and transactions. At Galpin, this meant significant administrative overhead and inefficiencies.

Mike Bosch recalls: > “We used a credit card machine and manually would enter the repair order number. Everything was kind of done outside of the DMS, and then we would balance it at the end of the day. It was a manual process to run reports and compare payments.”

Enter myKaarma. By integrating payments directly into the dealership’s workflows, Galpin eliminated manual balancing, automated reconciliation, and streamlined reporting. As Bosch explains: > “MyKaarma automatically distributes the payments in our DMS so that we don’t have to go in there and put that payment on the totals. That was a big win.”

Why Surcharging Matters

One of the most important recent innovations in payments at Galpin has been the adoption of surcharging. For years, surcharging wasn’t permitted in California. But as legislation evolved in 2024, Galpin seized the opportunity to pass rising credit card fees back to customers—with full transparency and compliance.

With myKaarma, surcharges are automatically calculated and applied when appropriate. Customers are clearly notified at the terminal or online portal, and they’re always given options to avoid the fee by paying with debit, check, or cash. This compliance-first approach ensures customers feel informed while helping Galpin save hundreds of thousands of dollars annually on processing fees.

As Bosch notes: > “We realized how much we’re paying in fees, which is very expensive for the stores. Since then, we went forward with surcharging. Surprisingly, we haven’t had too much pushback from customers.”

Surcharging has also reshaped customer behavior. Debit card use at Galpin has doubled, as customers recognize it as a no-fee alternative. Meanwhile, those who do pay with credit often see surcharges offset by card rewards, making it a win-win.

Enhancing Customer Choice

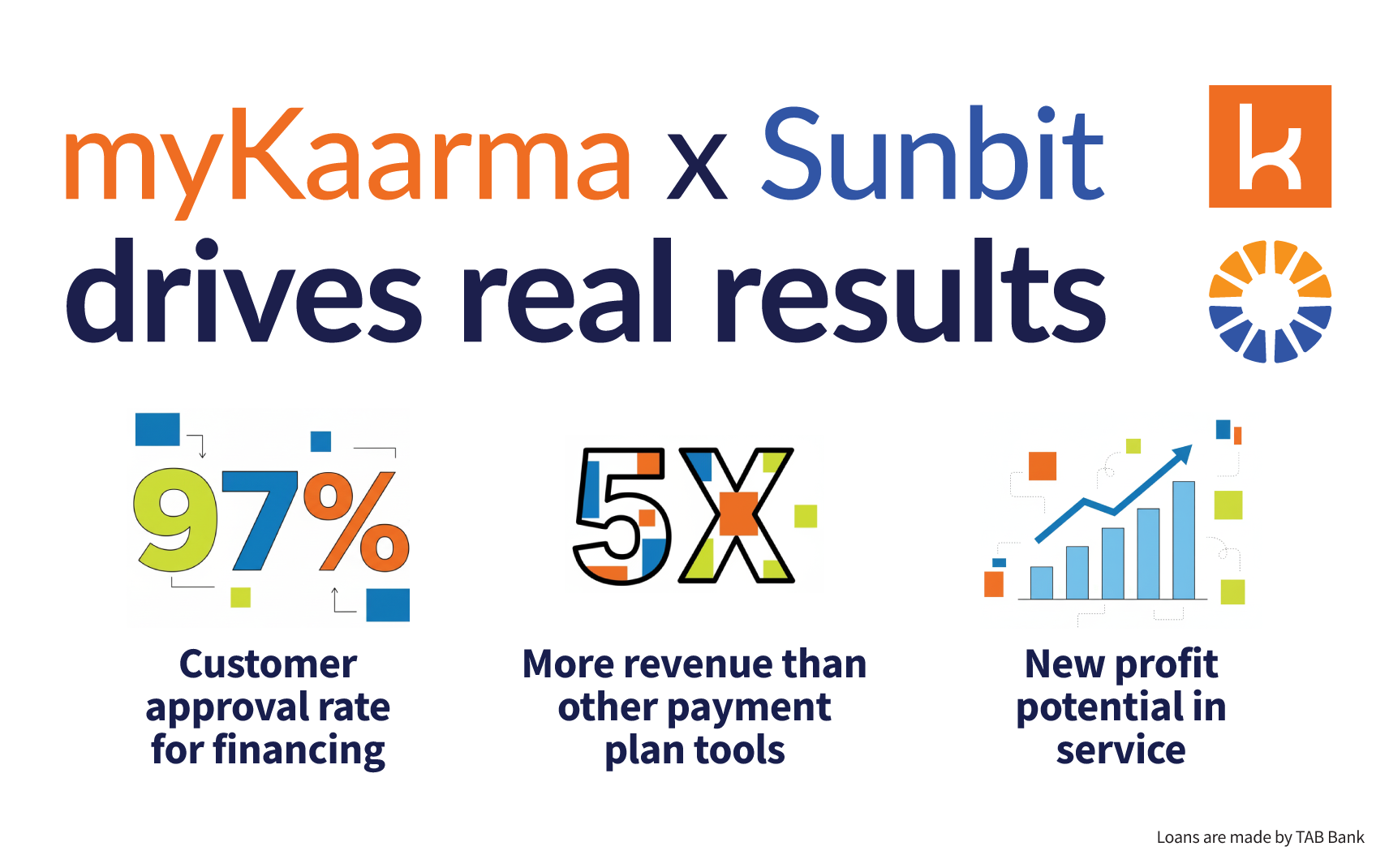

Beyond surcharging, Galpin and myKaarma have expanded customer options: – Mobile wallets like Apple Pay and Google Pay offer speed and convenience. – Financing through Sunbit lets customers spread payments interest-free, often used even by affluent buyers as a smart financial strategy. – Integrated notifications ensure customers know exactly what they’re paying, whether online or in-store.

Bosch emphasizes how customer choice matters: > “As much as we can get everything integrated into myKaarma, it’s helpful. Customers want to know their options—whether that’s debit to avoid fees or financing through Sunbit.”

Efficiency for the Business Office

Behind the scenes, the impact is just as powerful. Galpin’s business office now receives a single, accurate report at the end of each day, simplifying reconciliation. Fees are accounted for in real-time, and upcoming enhancements will further empower Galpin to self-manage disputes—cutting down delays and administrative back-and-forth.

As Bosch puts it: > “Now the store balances every day, and then the business office balances to what’s posted or credited into the checking account. It seems easier. It’s streamlined.”

The Galpin Difference

For Galpin, payments aren’t just a transactional necessity—they’re part of the customer experience. By working with myKaarma, Galpin has: – Reduced costs through surcharging. – Delivered transparency and choice for customers. – Simplified reconciliation and reporting for staff. – Reinforced its reputation as a leader in innovation within the auto retail industry.

Summing it up, Bosch highlights how easy the transition has been: > “The installation went really well. We can still refund and do everything we need to process payments. It didn’t take a whole bunch of training for the cashiers and service advisors. They just picked it up really easy.”

As customer expectations evolve, Galpin continues to set the standard for what a state-of-the-art dealership payment experience should look like—efficient, transparent, and customer-first.